Analysing the impact potential of a new energy acquisition for leading European investment fund.

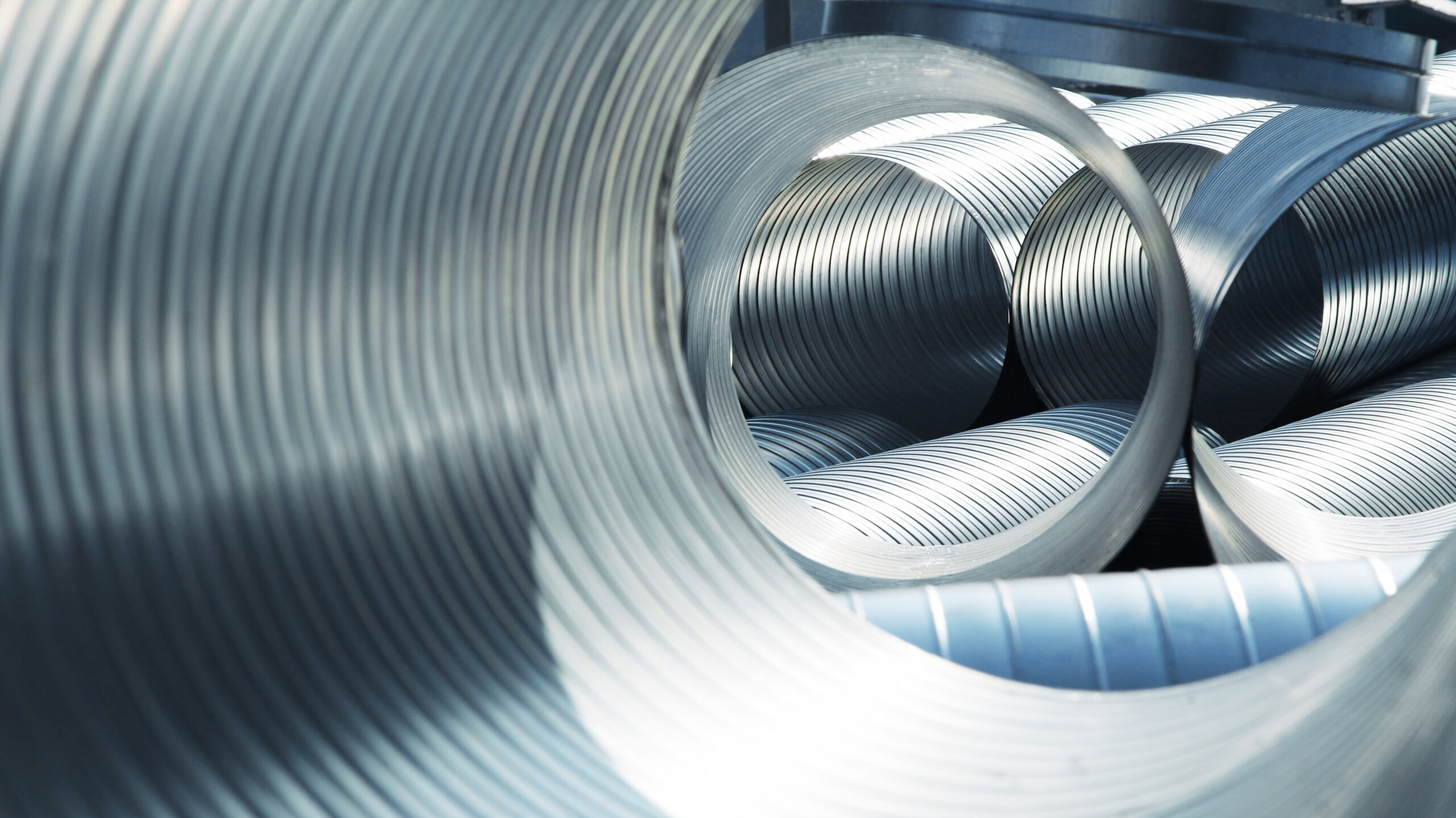

The client, a leading European investment fund, required support for their commercial approach and ESG due diligence of a target business operating within the offshore wind market.

Working with the Managing Partner and CIOs of the investment fund, Xynteo designed and executed the due diligence process aligned to investment objectives – engaging in a full assessment of the target’s macro context, industry growth drivers, competitors, defensible positioning, staffing model and in-house capabilities, and orderbook.

10

Commercial and ESG risks identified with associated mitigation plans

16

Tier 1/2 competitors benchmarked to assess competitive advantage

20

Value-creation opportunities identified and prioritised

The initiative

The key objectives for the engagement:

- Investigate and report on the target’s position in the global offshore wind value-chain

- Benchmark multiple tier one / two competitors to assess advantage and right to win

- Generate an evidence-based view of staff profiles to assess in-house capabilities

Xynteo’s role

Research and analysis:

- Evaluated the target’s commercial and ESG risks including their governance model

- Identified key industry constraints and modelled 10-year market growth

Opportunity development:

- Identified organic value-creation opportunities and 10+ potential acquisitions

- Developed an analysis report summarising findings for other potential co-investors