Despite the short-term fall in prominence for some ESG funds, the growth of ESG regulation has meant that demand for sustainability-linked products and services is here to stay. The question for asset managers and owners is how to respond to this increased regulatory responsibility.

The short-term picture for ESG funds at the end of 2023 remained mixed, with Article 8 and 9 funds experiencing net outflows of €22.7 billion. Reasons for this fall in investor appetite include macroeconomic factors such as geopolitical risks impacting supply chains, high interest rates, inflation, and recessionary fears.

However, in spite of these short-term concerns, major investors and managers such as UBS and Goldman Sachs continue to point to a strong long-term demand outlook for ESG funds. In 2023 alone, over 400 Article 6 funds had been upgraded to Article 8 or 9 representing over €120 billion. This change, according to SFDR’s classification system, places sustainability as a prominent outcome or core investment objective of the fund. It is safe to say that sustainability linked investing is here to stay and growing in prominence.

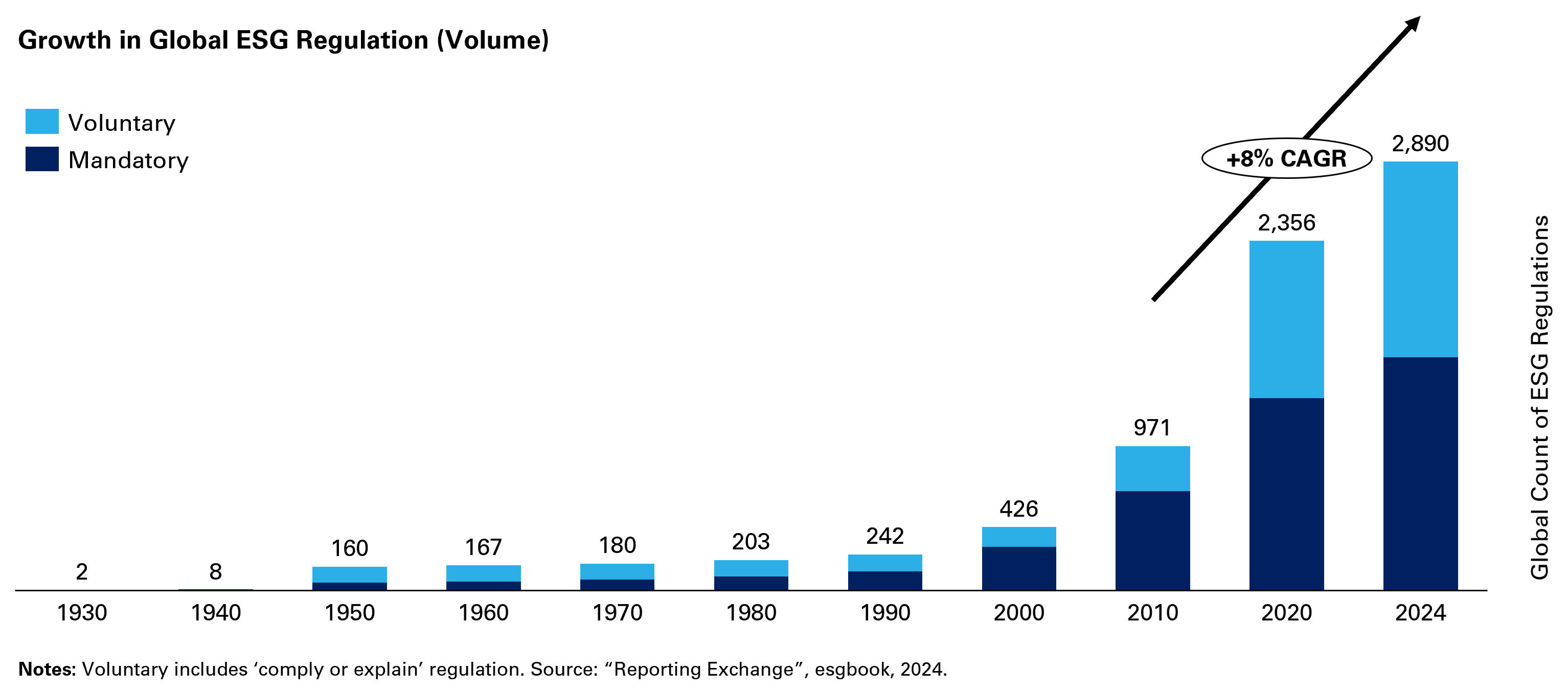

Growth of ESG Regulation

One of the most important drivers for this demand is the proliferation of ESG regulation. Research by ESG Book across more than 80 countries points out that ESG regulations have grown at 8% CAGR since 2020 with over 1,255 regulations introduced worldwide since 2011, translating to a net growth of 534 additional regulations to global statutes*. Whether we look at SB253 and SB261 in California, TCFD and SDR rules in the UK, or the raft of legislation in the EU (such as SFDR, CSRD, and CSDDD), recent regulations all point towards three common objectives:

- Integrate sustainability considerations into business decision-making;

- Track and monitor against a widening range of ESG metrics (incl. scope 1-3 emissions); and

- Prevent greenwashing accusations through applying a regulated labelling regime.

This leaves an important question for how private markets should respond to the expanding reach of ESG legislation. Broadly, we see three possible responses. Firstly, companies could ignore them and risk the financial, commercial, and reputational penalties. Secondly, companies could treat them as regulatory compliance issues and seek to update their business and disclosure processes to meet the minimum requirements. And finally, and our advised route, companies could see ESG regulation as an opportunity to lower their business risk and strengthen their commercial advantage.

At Xynteo, our view is that ESG regulations represent an opportunity for commercial growth. Not only does applying sustainability considerations to business decision-making help to identify otherwise unappreciated challenges to their long-term operations, from environmental litigation to stranded asset risks, tracking ESG metrics and applying clear labelling also provides an opportunity to strengthen value propositions offered to investors and customers.

Opportunity from ESG Regulation

For instance, the requirement to assess the emissions intensity of investments under the FCA TCFD-aligned disclosure rules provides a framework to measure market and climate risks posed by underlying assets for CLO and other managers. This awareness can, and should, lead to asset managers and asset owners working together to lower this risk, resulting in better environmental footprints as well as more secure returns for all parties. Similarly, the requirement to conduct a double materiality assessment under CSRD rules offers companies the opportunity to identify and align their ESG priorities with downstream customers and demonstrate why partnering together could provide greater win-win scenarios beyond simply providing a transactional product delivery. The same assessment can also outline broader opportunities for revenue generation, especially when combined with a circularity lens, or help outline a sustainability-aligned exit story to provide greater multiples for PE owners.

Three examples from our work at Xynteo can highlight these opportunities in action:

Example 1 – We worked with a European Energy Group (€2b market cap) to develop their sustainability strategy and market positioning. Our materiality assessment informed through engaging across their value-chains helped to identify emerging ESG regulations and trends relevant to themselves and their partners, increasing the relevance of their sustainability strategy to all stakeholders including government, investors, and customers. Ultimately, our work not only supported their own sustainability strategy but was also used to help them better position themselves for bids in European and Asian markets worth over €10b where their competitive advantage was built on both technical excellence and alignment to the broader objectives of their partners.

Example 2 – We developed a CSRD-aligned sustainability strategy for a chemicals company in Europe (€300m revenue) who produced a series of active pharmaceutical ingredients for the global pharmaceutical industry. A double materiality assessment, conducted in partnership with their global operational teams, identified several potential risks to their fuel and waste management processes that increased their carbon footprint and overall cost profiles. Ultimately, our work identified 8 key levers they could pull to improve their triple-bottom line returns (people, planet, and profit) including switching boiler fuel to agricultural waste (significantly lowering their scope 1 emissions) and upselling their waste products to other agricultural industries, potentially generating more than €60m in additional top-line growth.

Example 3 – We crafted a UN-PRI aligned sustainability strategy for a global fund (€20b AUM) that involved us engaging with their 10 largest portfolio companies to benchmark ESG maturity and risks. We identified a number of significant risks impacting the commercial growth of key assets including dependency on imported materials and talent attraction challenges to support expansion. Ultimately, in addition to developing a UN-PRI aligned and SFDR-informed strategy for the fund that also supported its treasury teams when engaging with partner financial institutions, we also developed 5 key fund-level opportunities that addressed cross-portfolio ESG risks. These included a cross-portfolio talent graduate programme that rotated across portfolio companies, leveraging aggregate brand benefits to channel talent to underserved companies, as well as developing circularity plays that converted waste from one portfolio company into feedstock for another, lowering supply-chain risks and import dependencies. The aggregate value of our recommendations exceeded €250m in annual top-line growth across portfolio.

How we support clients

We are often approached by clients to advise on how to respond to the myriad ESG regulations coming into force across the world. Our recommendation is that markets should see the opportunity in this space. If the objective was simply to meet the regulatory requirement at the bare minimum, then an auditing firm is best placed to this. However, where we help is to convert ESG regulation into sustainable value-creation that meaningfully impacts the bottom-line of a company and the multiple achieved for an asset. We do this by:

- Developing efficient compliance roadmaps that meet multiple ESG regulations within Europe and other geographies;

- Identifying and mitigating wider risks to operations that could strand assets in the near term or undermine credibility with investors;

- Attracting investors by differentiated (and regulated) sustainability labelling, especially those willing to offer premiums, with clear ESG stories; and

- Growing top-line revenue through catalysing high-premium demand by aligning ESG risks and sustainability competitive advantages.

Ultimately, Xynteo welcomes stronger ESG regulations, which not only clarify market signals but also level the playing field for firms wanting to pursue sustainable investments and operations. Our cross-sector collaborations – from large funds, corporates, governments, and commodity markets (e.g. aluminium, steel, and chemicals) – demonstrate that ESG regulation is a powerful driver for value-creation. We recommend everyone see it in the same way.

Learn more about how Xynteo is helping Private Equity chart a pathway to people and planet positive growth.

Find out moreStay up to date with our latest interviews by following us on social media (LinkedIn I Twitter), or Contact Us to find out how we can help your leaders and organisation create people and planet-positive impact.

* “Reporting Exchange”, esgbook, 2024. Voluntary regulations include ‘comply or explain’ requirements.