Xynteo was engaged to conduct commercial due diligence on a German clean‑tech holding company and its seven portfolio companies, assess portfolio value and leverageable assets, and shape investor pathways to attract new capital within existing debt constraints.

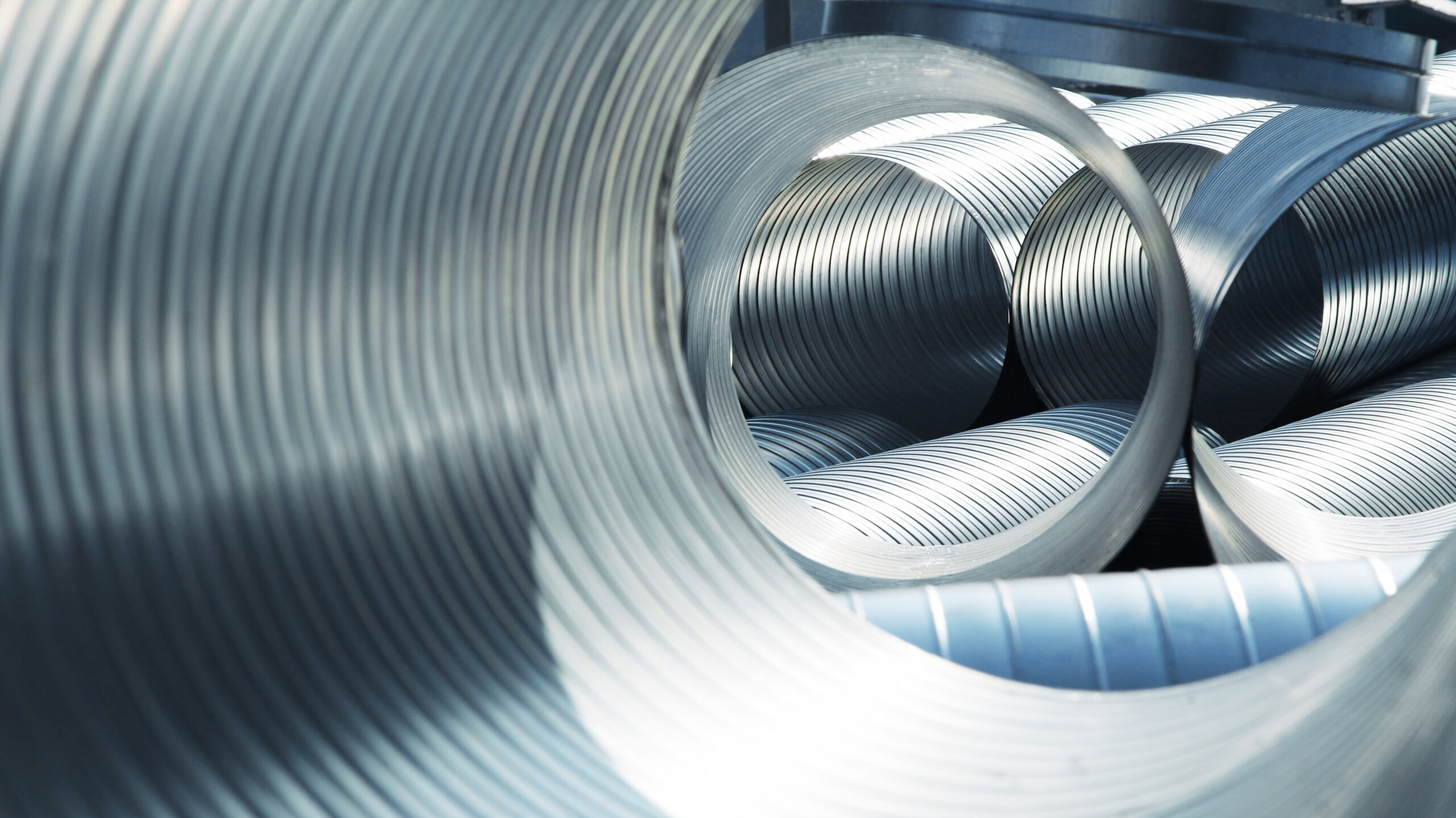

The client, a holding company based in Germany which invests in, incubates, and provides financing for clean-tech companies with maturity ranging between TRL7-TRL9 (i.e. very mature technology with little-to-no tech risk). It has built a portfolio of seven OpCos across areas such as thermal storage, solar panels, and material recycling.

Xynteo was engaged by the HoldCo’s Co-Founder, CEO, and its corporate investment banking team to conduct commercial due diligence, assess valuation scenarios, and support engagement with potential investors.

€280MM

Combined HoldCo and OpCo estimated value across scenarios

4

Investment pathways developed for potential investors after completing commercial due diligence

20+

Introductions to potential investors

The initiative

The key objectives for the engagement:

- Conducting commercial due diligence on the HoldCo and 7 OpCos

- Assessing portfolio value and leverageable assets across the group

- Designing investor pathways that address funding needs and debt constraints

- Preparing investment materials and engaging potential investors

Xynteo’s role

Commercial due diligence:

- Assessed the financial situation of the HoldCo, including all debts, equity, and shareholder bridges in a group level and at the OpCo level

- Assessed balance sheets of HoldCo and 7 OpCos to evaluate leverageable assets and liabilities

- Valued OpCos using a weighted pipeline approach, incorporating IP potential, R&D investment, and commercial traction

Information memorandum:

- Reached out to 20+ potential investors to introduce investment opportunity

- Built 4 investor pathways, combining valuation modelling with debt haircut strategies and upside

- Created investment memorandum and outreach materials tailored to institutional and strategic investors