India’s growing interest in low-carbon hydrogen reflects a broader global trend: several industrial sectors are beginning to explore transition pathways where molecular fuels may play a long-term role. Electrolyser (technology required for producing hydrogen from renewable electricity) manufacturing capacity is expanding, and early pilots are emerging across green ammonia, mobility, and steel. As attention shifts from technical feasibility to commercial viability, a key strategic question emerges: what actually drives green hydrogen from early projects into large-scale market adoption?

A systems-centred view suggests that green hydrogen’s technological innovation dynamics differ materially from other clean technologies. These differences, in turn, shape the extent to which deployment may rely on predictable carbon-cost signals rather than pure technology progression.

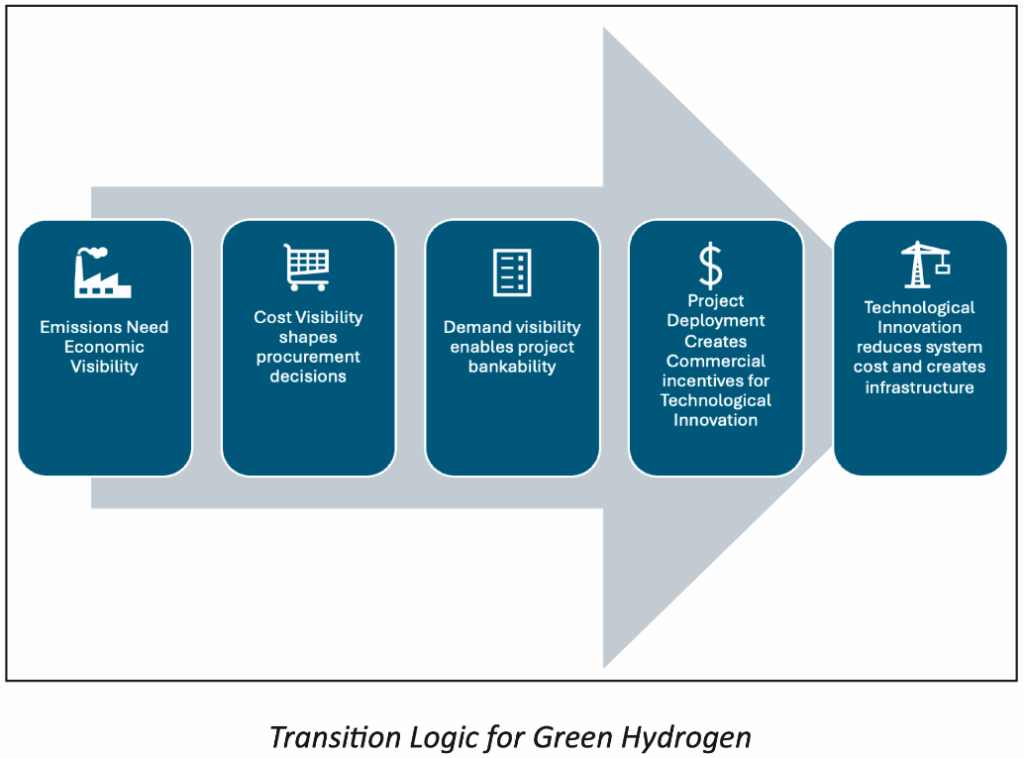

A Transition Logic for Green Hydrogen

Green hydrogen will likely mature through a sequence of reinforcing conditions:

- Technological innovation reduces system costs over time and strengthens the case for infrastructure investment. Pipelines, terminals, and storage assets require confidence in long-term utilisation.

- Emissions need economic visibility. This usually arises through carbon pricing, intensity obligations, or trade-related mechanisms.

- Cost visibility shapes procurement behavior. Industrial users adjust long-term strategies once carbon exposure becomes clearer.

- Demand visibility enables bankable projects. Long-term offtake commitments support investment in electrolysers, storage, and transport.

- Deployment creates commercial incentives for technological innovation. Field data and operational experience stimulate improvements across hardware and integration.

This chain highlights an important insight: in green hydrogen, real-world deployment tends to enable technological innovation, not the other way around. Early demand conditions, therefore, play an outsized role.

Why Green Hydrogen’s Innovation Trajectory Differs from Battery/Solar PV Experience

Green hydrogen is often compared to lithium-ion batteries or solar photovoltaics (PV), but the conditions that produced rapid cost declines do not map cleanly onto green hydrogen.

- Battery technologies benefited from early high-value markets. Consumer electronics absorbed initial costs and helped scale manufacturing. Green hydrogen’s early applications such as fertilisers, refining, chemicals, and steel, operate with tighter margins and limited tolerance for early-stage technology uncertainty.

- Battery & PV learning were driven by modular manufacturing. Cells and packs are standardised and produced in vast volumes, creating strong learning rates. Green hydrogen systems are larger, more customised, and more integration heavy. Learning tends to be slower and more dependent on deployment breadth.

- Battery & PV cost reductions drew from broader technological ecosystems. Advances in semiconductors, software, power electronics, and automotive platforms contributed materially. Green hydrogen systems draw from narrower supply chains, limiting cross-sector spillovers.

- Green hydrogen processes face clearer thermodynamic boundaries. Electrolysis efficiency, compression energy, and liquefaction penalties introduce physical constraints that shape the upper limit of improvement.

These factors do not preclude meaningful advances in green hydrogen technologies, but they indicate that innovation alone is unlikely to produce rapid cost declines without accompanying deployment scale.

Path Dependency: The Adoption Challenge is Distinct from Innovation Challenge

While the earlier section describes green hydrogen’s innovation characteristics, the adoption environment presents a separate challenge.

- Existing industrial systems are deeply optimised around grey hydrogen. Reforming units, ammonia loops, and refining processes are well-established. Transitioning to new feedstocks implies operational adjustments, new capex, and integration risk.

- Industrial decision cycles are long. Large plants operate on multi-decade horizons. Even when innovation occurs, adoption depends on the timing of maintenance cycles, replacement windows, and broader corporate investment plans.

- Commodity sectors prioritise predictability. Fertiliser, steel, and refining businesses typically avoid technologies that introduce uncertain reliability or unfamiliar O&M requirements.

- Green hydrogen lacks a natural early-adopter segment. Unlike batteries, where consumer electronics acted as a testing ground, green hydrogen does not have small, premium applications willing to pay for early performance. The first users are the hardest users.

This combination of high path dependency, long asset cycles, and absence of early adopter markets creates a structural “first step” problem: early adoption does not occur fast enough to stimulate the learning required for cost reductions. The innovation engine cannot accelerate until adoption begins, and adoption does not begin until the economics shift.

Why Predictable Carbon-Cost Signals Become Strategically Important

In this context, predictable carbon-cost signals help address both the innovation and adoption challenges.

- Carbon visibility strengthens early demand. Industrial users incorporate carbon exposure into planning when long-term obligations or prices are predictable rather than symbolic.

- Demand predictability improves project bankability. Financing conditions improve when developers can structure offtake agreements grounded in stable carbon-cost assumptions. Currently, as per the International Energy Agency (IEA), significant delay and project cancellations have been reported over the last 12 months primarily due to weak demand signals.

- Innovation becomes commercially meaningful. Incremental improvements in efficiency or reliability translate into quantifiable carbon reductions, enabling clearer business cases for new technologies.

- Infrastructure decisions gain strategic clarity. Network investments in pipelines, storage, and port capacity require confidence in long-term hydrogen throughput. Stable carbon signals support such expectations.

- Risk management becomes more tractable. Boards and investors can evaluate green hydrogen related options with greater certainty when carbon exposure is part of a predictable planning envelope.

None of these functions guarantee rapid cost convergence, but together they create the conditions under which green hydrogen can begin its learning cycle.

A Realistic Assessment of Green Hydrogen’s Tech Innovation Path

Green hydrogen innovation is progressing with over 80+ startups emerging in the space in India. India has initiated many of the building blocks required for a larger ecosystem through the National Green Hydrogen Mission (NGHM). However, the structural characteristics of green hydrogen: high capital intensity, complex industrial integration, and narrow learning channels, suggest that early deployment may rely heavily on economic signals rather than purely on technology-led cost declines, which appears to be predominant thinking in the ecosystem.

Predictable carbon-cost trajectories, whether delivered through markets, regulatory pathways, or trade-aligned mechanisms, can help improve early demand visibility and bridge the initial deployment gap. Over time, this may allow technological innovation to accumulate and system costs to fall in a more sustained manner.

Green hydrogen’s future will likely reflect a combination of technology improvement, policy clarity, and shifting global markets. Recognizing the interplay between these elements can help guide more grounded expectations about its commercial evolution.

This article first appeared in Hydrogen India Newsletter, January 2026 Vol III, Issue 1

For further information, follow us on social media (LinkedIn I Twitter), or Contact Us to find out how we can help your leaders and organisation create people and planet-positive impact.