India’s fertilizer industry, consuming 17–19 million tons of ammonia annually1, is undergoing a transformative shift with the adoption of green ammonia under the National Green Hydrogen Mission (NGHM). In August 2025, the Solar Energy Corporation of India (SECI) announced a record-low price of ₹49.75 per kg ($569 per MT) for green ammonia under the Strategic Interventions for Green Hydrogen Transition (SIGHT) program, a significant drop from the 2024 H2Global auction’s ₹100.28 per kg ($1,153 per MT)2. This milestone promises to reduce India’s reliance on imported ammonia by 30% (~720,000 tons per annum).

This article examines the price discovery, auction winners, cost drivers, broader implications, including import substitution, export potential, market development, and associated risks and mitigants, along with a detailed table of the auction winners.

Record-Low Price and Auction Winners

SECI’s first green ammonia auction awarded a contract to supply 75,000 metric tons per annum (MTPA) to Paradeep Phosphates Limited in Odisha, marking the start of 13 planned rounds targeting 724,000 MTPA. The winning bid of ₹49.75 per kg ($569/MT), secured by ACME Cleantech Solutions, narrows the cost gap with grey ammonia, priced at $515 per MT in March 20253, enhancing viability for phosphatic fertilizers, which do not require additional carbon dioxide for urea production.

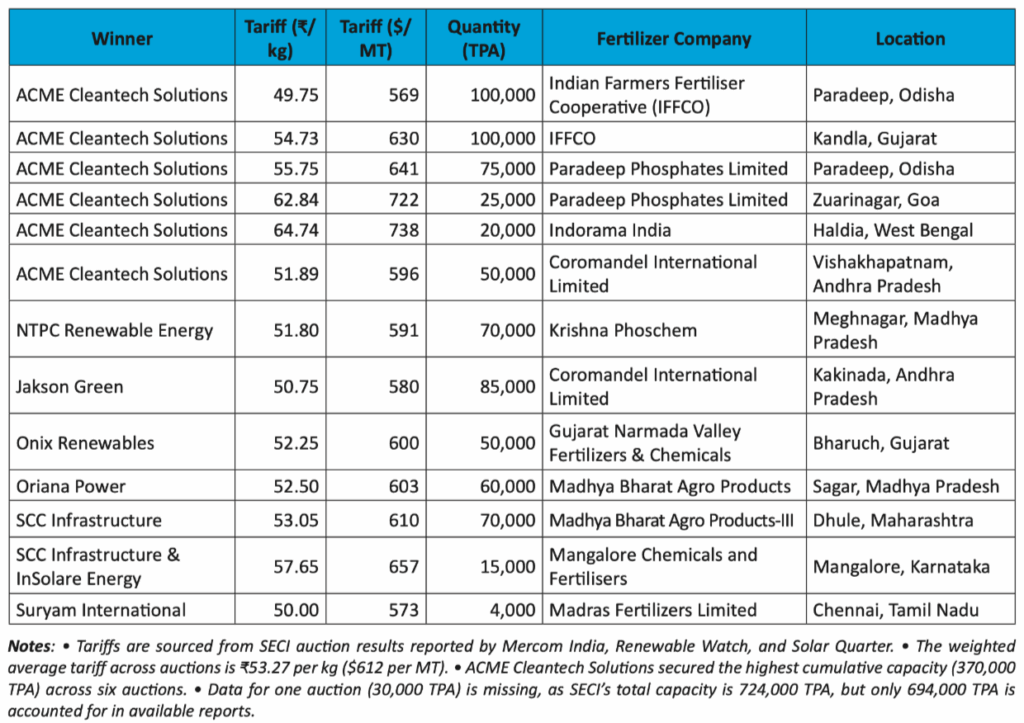

Subsequent auctions saw successes from multiple companies, with tariffs ranging from ₹49.75 to ₹64.74 per kg. Below is a comprehensive table of all known winners, prices, quantities, and fertilizer companies based on available data from SECI’s 13 auctions under Mode-2A-Tranche-I4:

Cost Drivers in Addition to Low-Cost Renewable Power

Policy Incentives

The SIGHT program, backed by ₹17,490 crore5 under the NGHM, provides subsidies (₹8.82/kg in year one, decreasing to ₹5.30/kg by year three). Central and state incentives include waived interstate transmission charges for 25 years and renewable power banking for 30 days, capital subsidies, duty waivers, surcharge waivers. State governments offer ₹5.05 lakh6 crore ($61 billion) in support, per a 2025 Council on Energy, Environment and Water (CEEW) study7:

- Odisha: ₹1.25 lakh crore, including ₹3/unit power tariff rebates and 30% capital subsidies

- Rajasthan: 100% exemptions on electricity duty, transmission, and wheeling charges for 10–20 years

- Uttar Pradesh: Up to 40% capital subsidies (capped at ₹225 crore) and land allocation at 5 acres per MW.

- Gujarat and Tamil Nadu: Capital subsidies, state GST reimbursements, and duty exemptions.

Reducing Electrolyser System Costs

Electrolyser system costs are declining, with China’s alkaline electrolysers at <$400 per kW compared to $800–1,200 per kW for Western models8, reducing capital expenditure by more than 60%. India’s manufacturers aim to lower costs to similar numbers as Chinese counterparts per kW, through domestic manufacturing and partnerships with Chinese suppliers, enhancing project economics.

Facilitative Green Hydrogen Certification Approach

India’s certification, requiring 2 kg CO2e/kg H2 and renewable energy sourcing, is less stringent than the EU’s hourly correlation and additionality rules, reducing compliance costs significantly. This flexibility accelerates deployment but may limit exports to stricter markets like the EU, necessitating future alignment.

Implications

Green Premium

The green premium, green ammonia’s cost over grey ammonia ($515 per MT in March 2025), is $126 per MT (24.5%) at $641 per MT. SIGHT subsidies, state incentives, and low-cost renewables drive this reduction. For phosphatic fertilizers, the premium is nearly negligible, but urea production faces additional CO2 capture costs, requiring further innovation to achieve cost parity. It is anticipated that government subsidies would largely absorb the premium, which could cumulatively cost ~1%-3% of the current fertilizer subsidy outlay9.

Import Substitution

Green ammonia significantly reduces India’s reliance on imported ammonia, which constitutes a substantial portion of fertilizer production. In 2023, India imported ~2 million tons of anhydrous ammonia, valued at $1 billion, primarily from Saudi Arabia, Bahrain, Oman, Indonesia, and Qatar10. The planned 21 million tons of green ammonia capacity in the near term could fully substitute imports annually, saving $2-3 billion forex outflow.

Export Potential

India’s low production costs position it as a potential exporter to Japan and South Korea, where green ammonia demand is projected to reach 8 million tons by 2030. Exports to the European Union require alignment with stricter certification standards, potentially increasing costs. Developing export infrastructure could unlock $4-6 billion in annual export revenue by 2030.

Market Development

The auctions foster a competitive market, attracting players like ACME, NTPC, and multiple other aspiring green ammonia suppliers. SECI has been effective in bringing together fertilizer companies to participate in the offtake, strengthening the green ammonia markets.

Annual ammonia demand growth of 1 million tons combined with an import substitution target of 1 million tons, in the near term, can provide stable demand outlook for suitable evolution of green ammonia market. This growth creates thousands of jobs by 2030 and encourages private investment and technology transfer, positioning India as a global green ammonia hub.

Challenges and Solutions

- Contract Duration Mismatch: SECI purchase contracts span 10 years, while projects last 25 years, creating financial uncertainty post-contract. Extending contracts to 20 years, as proposed by industry stakeholders, aligns with project lifespans, ensuring revenue stability and improving bankability.

- Policy Stability: Inconsistent policies could deter investment. State subsidies account for ₹5 lakh crore and many states that have announced incentives to provision 60% of the subsidy through already strained fiscal resources. Long-term frameworks with bipartisan support, backed by strong fiscal position, build investor confidence and reduce regulatory risks.

- Renewable Energy Variability: Variable solar and wind loads require reliable plant designs. Modular designs with battery storage or hybrid solar-wind systems, ensure consistent production, mitigating energy supply risks.

- Learning Curve: Developers face challenges handling gas molecules, especially new entrants. Partnerships with gas industry players are critical, and NGHM’s focus on skill development should effectively bridge this skill and knowledge gap, enhancing operational expertise.

- Financial Resilience: Strong balance sheets are critical to absorb cost or policy shocks. Government-backed loan guarantees and risk-sharing mechanisms with original equipment manufacturers (OEMs) and project developers could be required to assure investors and enable sustainable scale-up of the sector.

Conclusion

The record-low green ammonia price of ₹49.75 per kg, driven by SIGHT and state incentives, advances India’s fertilizer industry. Winners like ACME, Jakson Green, and others have leveraged policy incentives, access to favorable renewable energy resources, low-cost electrolysers, and an enabling certification regime, to narrow green premium. Beyond subsidies, green ammonia enhances import substitution, export potential, market development, and supply chain maturity, saving billions in foreign exchange and positioning India as a global hub. Mitigating risks through extended offtake, robust project and plant designs, and training ensures scalability, decarbonizing agriculture and strengthening India’s green hydrogen economy.

1 PIB; 2 Mercom India; 3 IMARC Group; 4 SECI press release; 5 1 crore = 10 million; 6 1 lakh = 100,000; 7CEEW; 8 Hydrogen Insights; 9 Umagine, CEEW; 10 World Bank

This article first appeared in Hydrogen India Newsletter, October 2025 Vol II, Issue 4

For further information, follow us on social media (LinkedIn I Twitter), or Contact Us to find out how we can help your leaders and organisation create people and planet-positive impact.