India’s aviation sector has grown rapidly over the past decade, with domestic passenger numbers increasing from around 50 million in 2010 to approximately 230 million in 20241. To address the sector’s rising emissions, the Ministry of Petroleum & Natural Gas, Government of India, set an indicative target of blending 1% Sustainable Aviation Fuel (SAF) in Aviation Turbine Fuel (ATF) by 2027, increasing to 2% by 2028 and 5% by 2030 for international flights2.

While modest compared to the European Union (EU)’s ReFuel EU mandate (2% by 2025, 20% by 2035), this step is ambitious in India’s context, translating into around 140 million liters (112 kilo tons) of SAF annually3,4. Meeting even India’s initial target will require a rapid scaleup in SAF production, but the availability of sustainable feedstocks remains a critical bottleneck.

India’s Feedstock Dilemma

Major SAF technologies differ in their feedstock requirements. Hydro-processed Esters and Fatty Acids (HEFA) primarily rely on oils and fats, including plant oils, animal fats, and waste cooking oils. Alcohol-to-Jet (AtJ) uses alcohols derived from sugars or starches, while Fischer-Tropsch (FT) depends on gasified biomass5. Given India’s immature supply chain coupled with infrastructural constraints for suitable oils, fats, and biomass, scaling aviation fuels remains challenging.

This underscores the need to diversify into hydrogen-based Power-to-Liquids (PtL) as a complementary pathway, particularly if India aims to achieve even the initial 1% SAF blending target.

Hydrogen’s Role in SAF Production

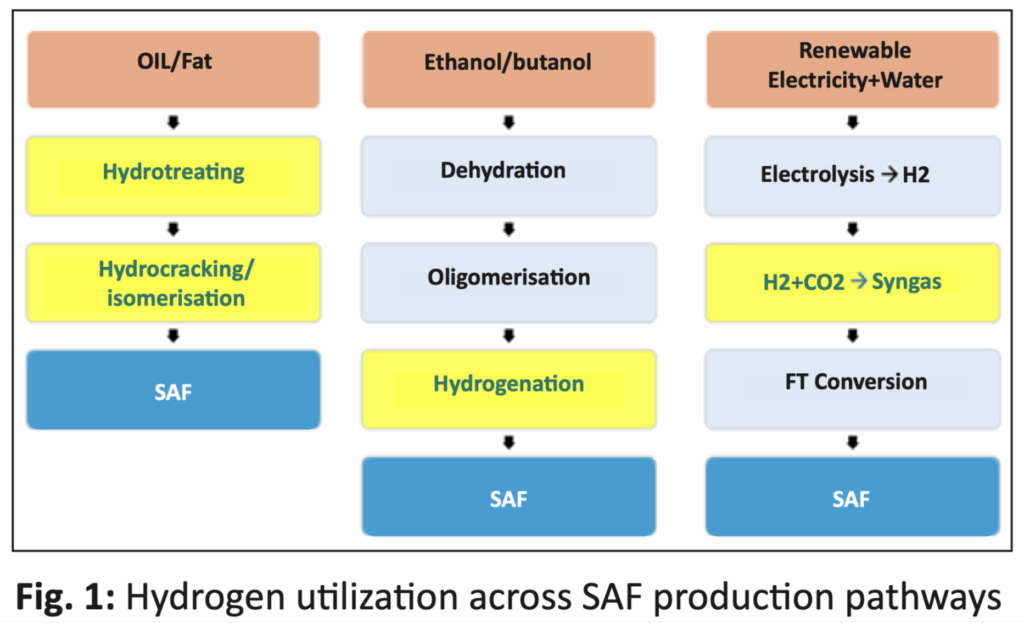

Hydrogen is not only a future aviation fuel in its own right, but also a critical enabler of SAF production across all major pathways. In the HEFA route, which produces most of today’s SAF, hydrogen is used in hydrotreating to remove oxygen from oils/fats. In the PtL pathway, green hydrogen combines with captured CO₂ to create syngas that is converted into synthetic kerosene. In the AtJ pathway, hydrogen is required in the hydrogenation step to stabilize intermediates from ethanol or iso-butanol. Together, these pathways highlight hydrogen’s critical role in producing aviation-ready fuels, making the alignment of India’s SAF and hydrogen strategies essential5.

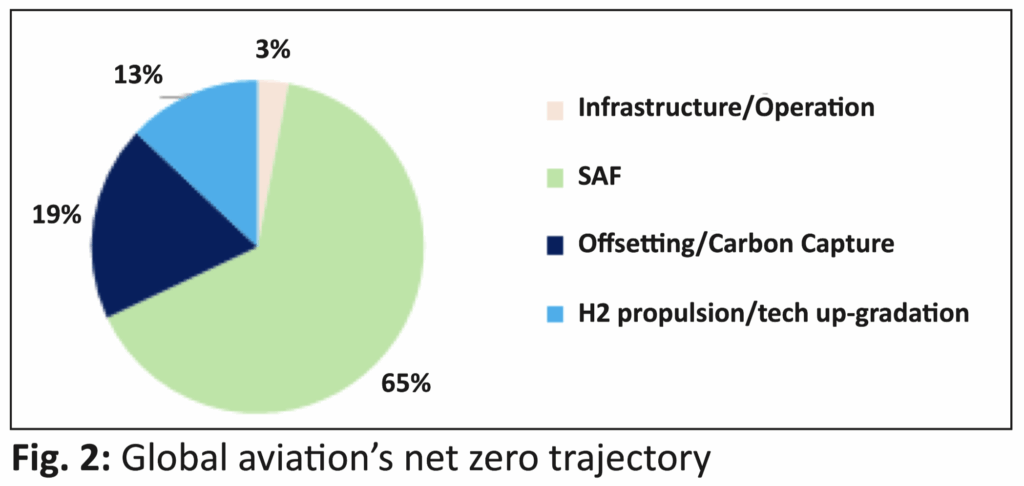

Globally, the International Air Transport Association (IATA) expects SAF to contribute nearly 65% of aviation’s emission reductions by 2050, with the remaining ~35% coming from hydrogen propulsion, efficiency gains, new aircraft technologies, etc6.

Hydrogen-based PtL Fuels are Essential

The hydrogen requirement for SAF production varies significantly depending on the production pathway. HEFA SAF requires approximately 50 kg of hydrogen per ton to support hydrotreating, while AtJ SAF also consumes hydrogen during the hydrogenation step to stabilize alcohol-derived intermediates. In contrast, PtL SAF, produced from green hydrogen and captured CO₂, requires roughly 660 kg of hydrogen per ton of SAF7.

To meet India’s 1% SAF blending target (~112 kilotons of SAF), this translates to ~5.6 kilotons of hydrogen for HEFA/AtJ SAF and ~74 kilotons for PtL SAF. Looking further ahead to 2030, with an estimated 16 MMT of ATF consumption8, achieving a 5% SAF blend (~800 kilotons) would require around 40 kilotons of hydrogen for conventional HEFA/AtJ SAF and roughly 528 kilotons for PtL SAF.

This represents about 0.8% of India’s projected 5 MMT (by 2030) green hydrogen target for HEFA/AtJ SAF and roughly 10.6% for PtL SAF, illustrating the substantially higher hydrogen demand for synthetic SAF production, and the critical role hydrogen will play in enabling scalable, sustainable aviation fuels in India.

Why Hydrogen Matters for India’s SAF Roadmap

With India setting its SAF blending targets, the critical question is not just how much SAF is needed, but how it will be produced at scale. Hydrogen provides a unique lever here, not as a competing fuel, but as the backbone of synthetic SAF pathways that can complement limited bio-based options.

Hydrogen strengthens India’s SAF strategy in several critical ways:

- Feedstock security: Relying on HEFA technology is not a sustainable long-term strategy for India, given its dependence on a weak and underdeveloped supply chain for oils and fats. These feedstocks are in limited supply and face high competition from the food and industrial sectors, placing additional stress on an already fragile system.

- Scalability: Unlike bio-based SAF, which is capped by land and feedstock availability, hydrogen-based PtL can scale in line with India’s renewable energy expansion. With ambitious targets of 500 GW of renewables by 2030, India has the potential to anchor a robust PtL supply chain for aviation.

- Policy alignment: India has already launched four hydrogen valleys in Pune, Kerala, Odisha, and Rajasthan, as regional innovation clusters for hydrogen production, storage, and use. These could anchor future SAF production units by supplying hydrogen directly to airport-linked blending facilities.

- Export opportunity: Mandates in the EU (2% by 2025, 70% by 2050), the UK (10% by 2030, 22% by 2040), the US (3 billion gallons by 2030 under the SAF Grand Challenge), and Japan (10% by 2030 for international flights) will create sustained global demand for SAF9. By aligning its SAF and hydrogen strategies with these international targets, India can position itself as a reliable contributor to global supply chains while strengthening its own energy transition.

Roadblocks on India’s Hydrogen-to-SAF Journey

While hydrogen offers a long-term solution for scalable SAF, its adoption faces significant economic, technological, and policy hurdles. Addressing these barriers is critical if India is to move beyond pilot projects and establish PtL as a viable pathway for aviation decarbonization.

- High costs: Green hydrogen in India today costs around $4–5/kg, which translates into PtL SAF costs of $8–10/l. This is far higher than the conventional process. For PtL SAF to be commercially viable, hydrogen prices need to fall closer to $2/kg, a level not yet achieved.

- Capital intensity and infrastructure needs: PtL production requires investment in large-scale electrolysers, CO₂ capture systems, and Fischer–Tropsch or methanol to jet conversion units. Developing this infrastructure involves multi-billion-dollar outlays and long construction timelines, making financing difficult without strong policy support or long-term offtake agreements.

- CO₂ supply chain: PtL SAF depends on a steady stream of concentrated CO₂. In India, carbon capture and utilization infrastructure is still nascent, and transporting CO₂ from industrial clusters to SAF plants adds cost and complexity. Building reliable CO₂ logistics is therefore a major bottleneck.

- Technology maturity: Unlike HEFA and AtJ, which are already proven at or near commercial scale, PtL remains at TRL 6–7 globally, with only a handful of pilot and early demonstration plants in operation. India lacks experience with such projects, creating uncertainty over efficiency, yields, and integration with refinery or airport operations.

Overcoming these challenges will require coordinated policy support, technology demonstration, and investment signals, without which hydrogen’s potential to anchor India’s SAF roadmap will remain unrealized.

The Way Forward: Unlocking Hydrogen-enabled SAF

To translate ambition into action, India must create the right policy, financing, and infrastructure environment. Key priorities include:

- Global positioning: Leverage India’s potential for low-cost green hydrogen to tap into export opportunities. With the EU, UK, US, and Japan setting ambitious SAF mandates, India can position itself as a competitive supplier to meet the emerging demand gap.

- Policy integration: Extend support under the National Green Hydrogen Mission (NGHM) to SAF projects, ensuring hydrogen use in aviation is explicitly recognized. This will align India’s aviation decarbonization with its broader hydrogen strategy.

- Demonstration at scale: Fund and fast-track 1–2 PtL pilot projects (similar to Norsk e-Fuel in Norway or Atmosfair in Germany) to build local experience, validate technology performance, and de-risk investment.

- Market creation: Provide targeted incentives for airlines through viability gap funding and tradable carbon credits to offset the current cost premium of SAF and send a clear demand signal.

- Hub development: Position refineries and major airports as dual decarbonization hubs. Refineries bring hydrogen expertise and proximity to CO₂ sources, while airports can host SAF blending and hydrogen pilots with major hubs. Together, these can create integrated supply chains linking hydrogen, CO₂, and aviation fuel demand.

Conclusion

India’s aviation sector is at a pivotal moment in its energy transition. With surging domestic air travel and established SAF blending targets, the challenge lies not in ambition, but scale, and here hydrogen is the critical unlock. Conventional SAF routes like HEFA are constrained by weak and underdeveloped oil/fat supply chains, while AtJ depends on biomass, which is already stretched across other programs.

Hydrogen, by contrast, enables PtLs, a pathway independent of traditional biomass-based feedstocks, scalable with India’s renewable energy growth, and capable of meeting both domestic and global SAF demand. By aligning SAF ambitions with the NGHM, and leveraging airports and refineries as decarbonization hubs, India can establish hydrogen as the cornerstone of a sustainable aviation future.

1https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=154274&ModuleId=3; 2https://www.pib.gov.in/PressReleasePage.aspx?PRID=1979705; 3https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=1925417; 4https://www.consilium.europa.eu/en/press/press-releases/2023/10/09/refueleu-aviationinitiative-council-adopts-new-law-to-decarbonise-the-aviation-sector/; 5https://www.iata.org/contentassets/d13875e9ed784f75bac90f000760e998/safhandbook.pdf; 6https://www.iata.org/en/programs/sustainability/sustainable-aviation-fuels/; 7https://rmi.org/the-five-dimensions-of-hydrogen/?utm; 8https://www.hindustantimes.com/india-news/india-presents-feasibility-study-on-sustainable-aviation-fuel-101756840796284.html; 9https://xynteo.com/wp-content/uploads/SAF-Paper-1410.pdf

This article first appeared in Hydrogen India Newsletter, October 2025 Vol II, Issue 4

For further information, follow us on social media (LinkedIn I Twitter), or Contact Us to find out how we can help your leaders and organisation create people and planet-positive impact.